Who Will Collect The Rental Income For Solar Energy In The 21st Century?

Summary

- In the “Age of Solar 1,” Solar PV SPV has passed 100GW installed generating capacity worldwide and is becoming a real contender as the primary replacement for fossil fuels.

- In the “Age of Solar 2,” the industry is forecast to grow more than 1000 fold in this century, and in the process, generate over 200 million jobs.

- SPV generation is twice as expensive in the US as in other developing countries. If this does not change, it will make our manufactured goods and our country less competitive.

- In the battle for the sun, the collection of the solar rent is moving from the utilities to third party lease companies as the representatives of financial institutions.

- For distributed SPV future, the “Sunowner” with batteries is the model. The user/owner does not pay rent for sunshine, nor does he need subsidies for SPV electricity generation.

The fossil fuels that accumulated over 4 billion years of photosynthesis are being exhausted. At the present rate of use the question is not if the end comes, but when. If there is a lower cost alternative to electricity generation and other forms of energy usage to fossil fuels such as Solar PV (SPV), it is our responsibility not to burn fossil fuels any longer than necessary, since fossil fuels are the source material for many other vital uses in life. Whatever will be the replacement for fossil fuels, its renewable energy comes from the sun. There are several manifestations of the sun’s energy that can be converted into electricity and other useful energy, but the most direct conversion is photons into electrons via Solar Photo Voltaic or SPV.

I have spent a half of a century in the R&D and commercialization of SPV. Hopefully, the reader can forgive me some bias toward this field. In my advanced age, I do not forgive myself any known distortions in presenting to the reader what I see as the possibilities of SPV future. This article was planned within my technological competence to examine the technological issues determining the future. It became clear very quickly, while technology is the basic determinant of future energy, the real battle for the sun is more an economic political battle for the very nature of our existence. Changing from fossil fuels to SPV has an effect comparable to moving from agriculture of the Middle Ages to the Industrial Age. About 25% of the GWP (Gross World Product) is direct energy generation but everything else is affected indirectly through the cost of energy. This changeover in energy could be a rare opportunity to introduce seamlessly, without violence, structural changes to our free market economy and help reduce the economic schism of our society.

This article is based on the basic prediction developed in a previous publication in SA that the lowest cost electricity generation will be SPV by the end of this decade. It is important that we get this right, since the magnitude of the changes involved can affect the structure of the whole economy and change the quality of our lives. In this spirit I invite the readers of Seeking Alpha to comment on any aspect of this paper, especially in designing a structure for an energy future where SPV is likely to play a central role.

The Age of Solar 1

In 2013, the developments of the past 50 years culminated in a worldwide cumulative SPV electricity generation capacity of 100 GW. Someone aptly called this first 50 years the age of Solar 1.

Some of the highlights of the age of Solar 1 include:

- Development and commercialization of crystalline Silicon c-Si technology close to its maximum theoretical efficiency of 22%.

- Development and commercialization of thin film based PV technologies, including amorphous Silicon, a-Si, Cadmium Telluride, CdTe, and Cupper Indium diSelenide, CIGS.

- Multi junction materials for space application reached over 40% efficiency. These devices are also the basis of high efficiency concentrating PV, CPV products.

- Cumulative installed capacity of 100 GW of SPV electricity generation was reached.

- The non-subsidized cost of SPV electricity has fallen to under $0.10 per kWh in areas of greater than 2000 hours of insolation and in selective countries.

- Past research indicates the direction of further improvements in PV materials and their efficiency as to how to reach generation cost of SPV electricity under $0.03 per kWh. This involves the use of multi junction thin films.

- The most important technological/economic challenge became obvious from the German experience. The installed SPV capacity has reached the limits, where any increase of further renewable capacity without storage will actually decrease the value of the already installed generation. Focus on large scale battery storage has become essential to the future growth of the SPV industry.

The most painful conclusion from past experience is the overriding role of available capital, confirming once more that vision without money is hallucination. The same capital also insures the continued movement of wealth to those who hold the capital.

The age of Solar 1 has shown the importance of a number of other building blocks of great importance to the industry; these are “job creation,” “the right way to use SPV,” “the dark side of SPV,” and the “battle for the sun.” While the present article focuses on “The battle for the Sun,” the author is also preparing publications on the other three topics.

Job Creation

SPV technology was born from the necessity of survival in securing an alternate energy source to the dwindling fossil fuel supply. It is an additional welcome benefit that SPV does not produce CO2. In our jobless economic recovery, an equally important role is abundant job creation by SPV. 1 million workers were employed worldwide in 2012 in the SPV industry. The US employment in SPV at the same time was 120,000 workers. Most of the US PV jobs are associated with installation and project financing. Many other aspects of job creation in the PV industry associated with manufacturing are smaller in the US, since those industries moved elsewhere. All efforts should be made to bring back PV module component manufacturing and manufacturing equipment assembly to the US, to maximize the job creation capacity.

How To Best Deploy SPV

The evolving SPV industry did not develop, as one would have expected, providing energy security and utilizing the inherent modular nature of the technology. When the industry started, we the researchers proudly declared here is high technology for the “have nots.” It did not turn out that way. Instead in the developed world, large centralized utility interactive PV fields dominate over 90% of the PV market with several undesirable consequences:

- When the grid is out, your PV generated electricity is wasted, thrown away. (We have at home a 10kW SPV field, but during Hurricane Sandy, we had no electricity of any kind for a week.)

- Instead of generating the SPV electricity locally, we wheel it sometimes 1000 miles to the user, incurring substantial grid losses.

- The utilities and the industry advanced the notion that instead of local storage, we must stay with central utility controlled power and let the grid be our storage.

The awakening opposition of the utilities to SPV can also characterize the change to the age of Solar 2. The utilities, while they had the chance, did not invest aggressively in PV projects, letting “third parties,” including financial institutions, take over this role. Now with the emphasis on distributed “rooftop solar,” they suddenly realize that they may have lost the greatest opportunity in the coming shift to renewable electricity generation.

Distributed residential and commercial rooftop installations are becoming more fashionable, but here again for the time being the utilities control the delivery of SPV electricity, through grid interactive inverters without any local storage. Nonetheless, the mix of central utility SPV to distributed SPV is changing. In the coming age of Solar 2, the percentage of distributed solar will increase.

The Dark Side Of SPV

In the age of fossil fuels, we have burned a lot of carbon containing compounds, generated a lot of CO2 and contaminated our atmosphere. This contamination is spreading beyond geographic borders carried by winds around the globe. The darkest side of the SPV industry is the potential contamination of our local fresh water tables and our land by the large-scale installations of toxic and carcinogenic SPV materials in our back yards. We are still at the beginning of the truly large-scale installations and commercialization of SPV; we must put regulations in place now that prevent pollution. We cannot allow the replacement of atmosphere contaminating fossil fuels by land contaminating renewable energy. An appropriate and adequate control of the PV industry enforcing environmental safety should be the first order of business.

The Battle For The Sun In The Age Of Solar 1

In the battle for the sun during the Age of Solar 1, the utilities definitely controlled the industry and controlled the solar rent, whether it came in government subsidies or in other forms of taxpayers’ or ratepayers’ obligation. In the same period, 100GW SPV installations were completed at the cost of $0.5 trillion. Of this amount, less than half has gone for hard costs to manufacturers and installers and the other half, containing most of the subsidies, has gone to large scale project owners and project financiers. Most of the manufacturers and installers are bankrupt or out of business, while the capital providers’ wealth has increased substantially.

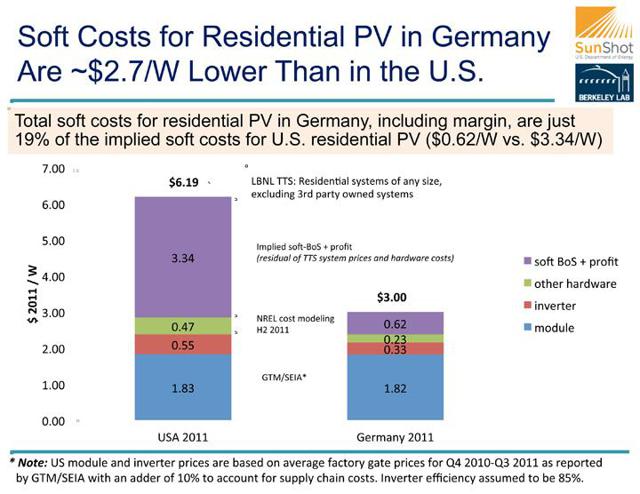

Figure 1

A further distressing consequence of the past deployment of SPV has established a substantially higher cost industry in the US than the rest of the world. A recent study (Figure 1, Table 1) funded by the DOE attempted to analyze the reasons for the substantial cost difference. While this specific detailed study was carried out in the US for 2011, the ratio of cost difference remained the same for 2012 and 2013 (see Table 1). The large difference between the cost of SPV in Europe and the cost in the US is designated by the DOE study as “soft costs.” The hardware costs are essentially the same everywhere; there is some difference in the cost of labor compared to China, but not compared to Europe. Most of the soft costs really can be explained as the added overhead of the third party financial leasing company that has been interjected into the marketing chain, added to it the cost of money through a number of cumulative financing steps. In any case, the profits associated with the soft costs do not stay with companies manufacturing and installing hardware, but go to shareholders, banks and lenders.

In the first 50 years of the history of SPV, the utilities have collected most of the rent payments for SPV electricity. Through the third party rooftop leasing model, the rent collection for SPV electricity is shifting to the big banks and Wall Street.

Comparison of different SPV installed system costs:

(click to enlarge)

| Utility US | Utility Germany | Without battery | Sunowner | |||

| ($/W) | US *rooftop lease | US rooftop purchase | German rooftop purchase | Rooftop owner with storage | ||

| 2013 price | 2.40 | 1.35 | 5.50 | 4.50 | 2.30 | 5.00 |

| 2012 price | 2.80 | 1.85 | 7.90 | 5.87 | 2.62 | |

| 2011 price | 3.50 | 2.20 | 8.50 | 6.19 | 3.00 | |

| 2010 price | 5.00 | 3.20 | 9.65 | 6.91 | 4.25 | |

Table 1

The Age of Solar 2

The Magnitude Of The SPV Industry - The Solar Prize

In estimating the magnitude of the SPV industry in the 21st century, this article uses several forecasts. My previous SA article, “Trends In The Cost Of Energy”, linked above, outlines a cost evolution of solar PV, according to which by 2020, SPV generated electricity will be the lowest cost electricity generation at below $0.05/kWh. In the same article, the route to this cost is also outlined, by promoting multi junction thin film PV devices.

From the other side of forecasting, we look at the forecasts of the IEA, Shell Oil and Greenpeace for the magnitude of the SPV industry in the 21st century.The industry growth actually surpassed all three of these forecasts between 2000 and 2013. IEA numbers were farthest from the actual growth, missing by a factor of 10.

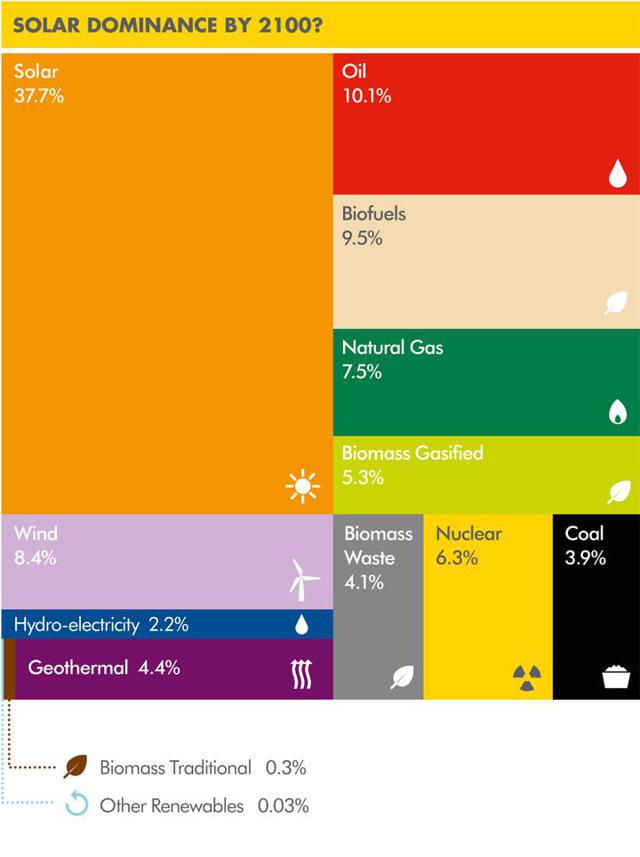

For the second half of the 21st century, IEE predicts 8,000 GW, the “Ocean” branch of the Shell Oil study (Figure 2) predicts 60,000 GW, and the Greenpeace forecast comes in at 100,000 GW of SPV in the energy mix by 2060.

On Figure 2, the Shell (NYSE:RDS.A) (NYSE:RDS.B) forecast shows a 37.7% penetration of solar of the total energy mix at the end of the century. The Shell forecast for 2060 for SPV penetration is 25%, or 209.6 EJ per year. This energy forecast per year converts into 100,000 GW SPV cumulative electricity generation, which is within the range of the Shell forecast. This is the number this article will use as the magnitude of the industry to be established in the next 50 years. This is a 1000 fold increase compared to the installed capacity in 2012.

The economic value of this cumulative industry, if we assume $1 per watt installed system cost on the average, is $100 trillion. This $1 per watt cost is a reasonable estimate, considering that in 2014 utility scale SPV is being installed in Europe at 1 euro per watt ($1.35/W).

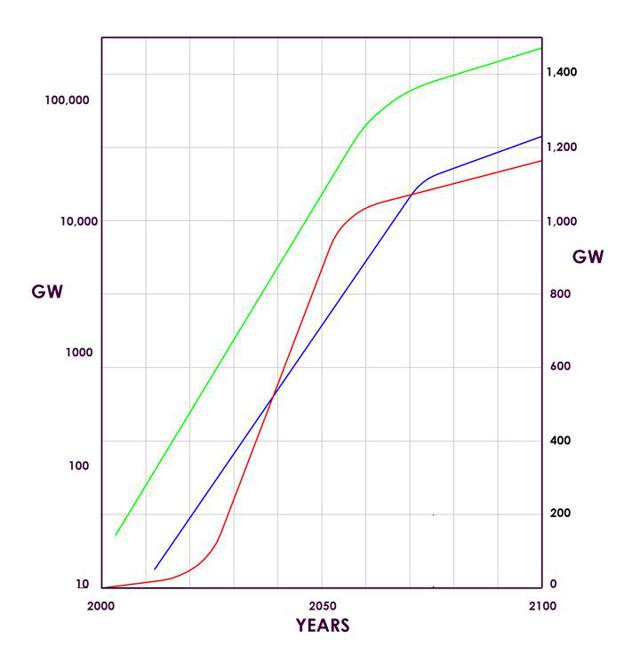

The growth of the industry is shown on Figure 3. This graph was prepared by the author, starting with historical numbers prior to 2014, and ending up in 2060 with the forecast of the Shell study. Between 2014 and 2060, 20% growth was assumed. The graphs combine three curves. On the logarithmic scale, the cumulative installed capacity is shown for the world (green graph) and the US (blue graph). The S curve (red graph) on the linear scale (right) is representing the annual US installed capacity of the SPV industry in the 21st century.

(click to enlarge)

Figure 3

The growth of the industry in the past decade in different geographic regions ranged from 20% to 100% per annum. The 2014 growth worldwide is expected to be 48 GW per year or 36%. The cumulative installed capacity growth spans six orders of magnitudes on the logarithmic scale, going from a $1 billion value in 2002 to over $100 trillion value for the cumulative installed capacity during the first 60 years of the century. Beyond 2060 we assume a linear growth of 3% per annum, (as forecast in the Shell oil report). In addition to this 3% increase in the energy consumed, an additional 4% replacement business will have to be serviced, going with a 25 years amortization of both the SPV power projects and the component manufacturing facilities. For the US, this converts to annual 1200 GW of both component manufacturing and power project installation. This is the basis of a century of sustained employment and required investment. Extrapolating from the experience of the age of Solar 1, a worldwide SPV industry in 2012 employed 1 million workers to manufacture and install 35GW of SPV with an employment creation of 29,000 jobs per GW. The graphs of Figure 3 forecast about 30 million jobs for the US and over 200 million SPV jobs worldwide. Before this development can happen, several serious obstacles have to be overcome.

The Technical Challenges Of Solar 2

A) Further cost reduction of SPV modules

The most important goal is to reduce further the cost of SPV generated electricity from the present $0.10 per kWh by an additional factor of 3 to below $0.04 per kWh (in areas of insolation of 2000 hours). This cost reduction is feasible based on past research. There are several potential avenues pursued by different groups. The author believes that multi junction thin film device is the route to lowest cost with least resistance to achieve the goal of greater than 30% SPV conversion efficiency. This will result in a module manufacturing cost of under $0.3 per watt. The scientific talent and political will together with financial commitment has to be mustered to pioneer this development. Certainly the scientific talent is here in the US to do the job, (some of it unemployed), but due to lack of financial commitment, the first generation SPV technology c-Si manufacturing today is in China. We hope this will not happen for the next generation SPV technologies.

B) Energy storage

A common view advanced in the energy industry that there is no suitable storage technology to go with solar or wind power. Certainly present battery technology can go a long way to solve this problem. The table below shows a comparison among the various types of rechargeable batteries (see Table 2, prepared by the author). The two battery technologies most used today are Lithium and Lead acid.

Table 2

| Type of battery | Lead acid | NiMh | Lithium | NiFe |

| Wh/kg | 35 | 60 | 200 | 50 |

| Wh/liter | 65 | 230 | 300 | 150 |

| Power W/kg | 180 | 500 | 1,500 | 100 |

| Cycles | 800 | 1,500 | 1,000 | 10,000+ |

| Initial Cost $/kWh | 200 | 600 | 500 | 250 |

| Levelized life $/kWh | 0.50 | 0.50 | 0.50 | 0.025 |

There are several versions of Li batteries, some used in electric vehicles. From the table above, one can see the parameters. The Li batteries have the highest energy densities, but their drawbacks are life cycle cost and they can explode. Lead acid batteries are of more moderate cost, but are toxic. The oldest battery technology developed by Edison around 1900 is NiFe, needs a new look. Advantages of NiFe batteries are: i) there are no toxic or carcinogenic materials in the product, ii) the battery is deep discharge capable, iii) it is not damaged by overcharge or over discharge, iv) the battery has a very long life, virtually indestructible. The life cycle cost of NiFe batteries, the cost of storing 1kWh of electricity, is about 2.5 cents per kWh. With further optimization, NiFe battery can provide acceptable storage costs.

C) Present US deployment of SPV is too expensive

Some of the flaws of SPV deployment have been discussed. We have also noted that looking ahead, the rooftop SPV installations increase compared to utility scale projects. The large majority of this installation is done by third party leasing companies. A recent SA article and associated comments succinctly analyze the case of the largest leasing company, SolarCity (NASDAQ:SCTY). Unfortunately, all these rooftop installations continue to use utility interactive inverters, keeping the fatal flaw of wasting SPV electricity when it is needed most. As can be expected the cost of the leased systems is substantially higher than the purchased systems. If we look at for example 2012 prices, (Table 1) US rooftop leasing cost is three times what the same rooftop costs in Germany. As the percentage of SPV in the energy mix increases, the cost of US made goods will have to carry this unnecessary higher energy cost, making US goods not competitive.

D) The guidelines for an optimum residential SPV system

In an ideal, socially just world, what would be the best deployment of SPV generation?

- The user owns the generating equipment. The “Sunowner” (SO) becomes the user/owner’s SPV stand-alone power station, UPS.

- SO generates SPV electricity when the sun shines with least losses.

- SO has local storage (battery or other) so that electricity is also available when the sun does not shine.

- SO becomes part of an existing smart national grid, connected and separated through the batteries from the grid, either contributing to the grid when the user has excessive stored energy, or taking from the grid when his stored energy is inadequate. There is no feeding the UPS AC power back to the grid.

- The user owns his generating equipment, does not pay rent or tariffs to anyone for the SPV electricity generated. There is no need for any subsidies in the form of feed in tariffs or net metering. The home generated electricity does not even has to show up on the utility meters.

To bring about the world of “Sunowners,” there has to be adequate affordable private or public capital so that the user can take out a loan if needed to purchase his SPV generator.

Can The Economy Generate Enough Capital To Change Over From Fossil Fuels To SPV?

To answer the above question, we will estimate the cost of conversion to SPV and compare it to the cost of staying with fossil fuels.

The US annual electricity usage is 4,000 billion kWh {4×10(12)} kWh. If this energy is generated entirely by SPV, assuming an average insolation of 1500 hours and 80% overall efficiency, we would have to build 3,400 GW cumulative SPV generation capacity to replace the presently existing fossil fuel and nuclear-based US capacity. Furthermore if we go to an entirely SPV generation, we would have to install at least 2,000 billion kWh of storage capacity.

According to Figure 3, we start with the existing 10 GW US installed SPV capacity in 2013 and with 20% annual growth rate, we reach 1000 GW capacity by 2040. Assuming an installed cost of $1 per watt between now and 2040, the 1000 GW of SPV will cost $1 trillion, or an annual investment of $40 billion. To replace fossil fuels on this scale, we have to add battery storage. If we take California as an example with its energy use profile, for every kW of SPV, we need to add 4kWh of storage. NiFe batteries, at a cost of $250 per kWh, would double the installed system cost to $2 per watt, requiring an annual investment of $80 billion per year. While this is a sizable amount, it certainly is not an obstacle for a country with $15 trillion economy.

As we further expand beyond 2060 and reach the 1200 GW leveling off on the S curve, we reach the annual production valued at $1 trillion per year; if batteries are also included, $2 trillion per year. This is 13% of the US GDP today. Our actual energy costs using fossil fuels for 2014 are estimated over 20% of GDP or $3 trillion. If fossil fuels remain dominant to the second half of the century, this cost will definitely increase substantially.

Are There Any Materials Limitations That Would Prevent Conversion To SPV?

To answer the above question, we have to look at the rare materials like Cd and Te in CdTe, In and Ga in CIGS. There are several material combinations that can replace the ternary compound materials, e.g., Sn and Zn. The other rare materials used in batteries are Ni in NiFe batteries and Li in Lithium batteries. The natural abundance of these materials in the earth’s crust is very large compared to what we are likely to need for SPV generation. The problem is the rate of mining and extraction existing today is only adequate to reach a growth rate of about 200 GW per year. This growth is expected to be reached before 2025. For certain materials like Te in CdTe, the available material is only adequate for 5GW production per annum. An other example is Li for batteries. Recently, Tesla (NASDAQ:TSLA) announced plans for a 30GWh Li battery factory. For only that to happen, the amount of Li extracted would have to be more than doubled compared to today. It is important to emphasize again that this is not materials limitation, but the rate of extraction, which has to be addressed.

Concluding Remarks

In the Age of Solar 2, the SPV industry has reached cost parity with existing competing technologies of electricity generation. The majority of fossil fuels for energy generation can be replaced with Solar PV in the next 50 years. This involves constructing over 100,000 GW of new SPV generation. The capital required is reasonable for the world economy, but the extraction of key materials has to be increased substantially to meet the needed growth targets.

The SPV industry with the unprecedented growth will surely be one of the most exciting investment opportunities of the next decades. The required increase in the extraction of several limiting materials mentioned above should be looked at. Most importantly, shortages for SPV are likely to occur for In, and Ga and for battery materials Li and Ni.

The c-Si manufacturers have used up much of the excess inventory and many of them are looking forward to renewed growth and profitability. SunPower (NASDAQ:SPWR) has a solid technology and game plan. Many of the Chinese c-Si players will show strong growth.

Thin film SPV technology will reemerge as the important alternative for further cost reductions. CIGS and other multi junction thin films such as Hanergy (OTC:HNGSF) in China and Stion in the US warrant attention.

The whole industry of residential and commercial stand alone UPS installations, the “Sunowner” model, are waiting to be funded. At this time, there are no established public companies on the market, but there are a number of small private companies are starting to offer the stand-alone systems with batteries for the residential market.

On the negative side, as the education of the public increases about SPV, the inherent disadvantages of the third party leasing model will limit their expansion. There are a number of companies in this category, the largest public companies are SolarCity, followed by SunEdison (NYSE:SUNE). Also a number of private companies backed by large financial institutions like Vivint Solar, Verengo, etc., belong to this group. These companies not only bring with them a high priced US SPV industry, but they lock their Main Street clients into solar rent payments at a time when SPV prices will continue to decline substantially.

Companies that are using toxic and carcinogenic materials will have to come to terms with their associated contingent liabilities. First Solar (NASDAQ:FSLR) is the most notable company in this group. First Solar is the only company left that uses CdTe in large quantities. It has been shipping product for several years so that issues associated with the end of life responsibilities of the installed fields are not far away. It has changed its policy about recycling recently, but that does not remove contingent liabilities of site contamination.

Finally, we must recognize our social responsibilities as we construct the clean renewable SPV infrastructure to replace fossil fuels as our primary energy source. We all should help to insure that all of us can enjoy free sunshine not only to darken our skin, but also to generate our SPV electricity. “Let there be light,” said the Lord.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.